Mortgage Q&A: “Can I refinance a mortgage with negative equity?”

Nowadays, more and more homeowners are finding that their condo or home value isn’t worth what it once was at the height of the real estate market.

In fact, many are discovering that their current mortgage balance(s) now exceeds the value of their property, putting them in a position of negative equity, otherwise known as being upside down. Or put another way, the proud owner of an underwater mortgage.

Okay, maybe not proud. Perhaps panicked is a better adjective. To make matters worse, mortgage payments are also resetting higher as teaser rates disappear and ARMs adjust.

Let’s learn more about negative equity and its ahem, negative consequences.

What Is Negative Equity?

- If equity means ownership

- Negative equity must mean a lack thereof

- So in the case of a mortgage

- It means you owe more than the underlying asset (home) is worth

As noted, when you owe more on your home loans than your property is worth, it is considered being in a negative equity position.

For example, if your home is currently worth $300,000, but you have an outstanding mortgage loan balance of $400,000, you’ve clearly got no equity. But it’s worse than that. You actually have $100,000 in negative equity.

Hmm, have might be the wrong word, since it’s more a lack of having anything, namely, equity.

Anyway, this doesn’t necessarily mean you have to take action, as your loan balance will dwindle over time with regular principal and interest monthly payments. It just means that for the moment, you don’t have any home equity.

As such, you won’t be able to sell your property because you’d owe at least $100,000 to the bank, as the proceeds of a sale wouldn’t cover the entire outstanding loan balance. There would also be real estate agent commissions and closing costs to worry about.

For most, this would effectively prevent a home sale because no one wants to take a big loss, nor can many afford to take such a big loss.

At the same time, a mortgage refinance typically isn’t an option if you lack home equity, or even if you have very little of it.

You generally need some equity cushion in order to refinance, whether it’s 3%, 5%, or 10%. But that changed as a result of the mortgage crisis.

Negative Equity Rising

- Negative equity levels surged after home prices peaked in 2007

- Because property values plummeted quickly

- And the batch of mortgages at the time were high-LTV and/or interest-only

- Meaning many homeowners didn’t have much equity to begin with

Negative equity has been on the rise over the past few years as a result of falling home values and high loan-to-value (LTV) loans, you know, the ones where borrowers put next to nothing down. Or actually took out a zero down mortgage.

In the early 2000s, it was the norm to purchase a home or refinance an existing loan up to 100% LTV. Since it was readily available with just about any mortgage lender in town, borrowers opted to keep their cash in their bank accounts.

Unfortunately, this meant any decrease in home prices would put these same borrowers into negative equity positions almost immediately.

Put simply, if you start out with little or no home equity and then your property value declines, you’ll quickly find yourself in the red. This has been the case for millions of Americans in recent years.

Even if you did come in with a nominal down payment, say 5-10%, the massive home price declines alone could have pushed you underwater.

Unfortunately, many of these same borrowers also elected to take out adjustable-rate mortgages, or even worse, option arms, with the latter allowing for negative amortization. This meant most couldn’t even keep up with monthly payments, or refinance to get payment relief.

So they gave up on their homes and their mortgages, and chose to pay other bills like student loans, auto loans, and credit cards while they went back to renting.

Ironically enough, the mortgage indexes tied to these adjustable-rate loans are now super low, meaning many resetting ARMS are actually lower than anticipated. But this is only temporary, and certainly doesn’t provide long-term security.

The fact of the matter is many homeowners, even those deeply underwater, want to take advantage of the record low fixed mortgage rates currently available, and who can blame them?

However, most mortgage lenders frown upon borrowers with little or no home equity; not to mention the fact that many banks lowered maximum LTV ratios in light of the mortgage crisis.

So, how can a borrower refinance if they have negative equity? Well, the U.S. government saw what was happening and decided to step in and lend a big hand.

HARP Allows Borrowers to Refinance with Negative Equity

- There are now loan programs available for those with negative equity

- Including the Home Affordable Refinance Program (HARP)

- And other streamline options for non-Fannie Mae and Freddie Mac loans

- That don’t prevent borrowers from refinancing based on LTV

Earlier this year, the Obama Administration created the so-called Home Affordable Refinance Program (HARP), which allows underwater borrowers (those with negative equity) to refinance in order to take advantage of the record low mortgage rates, thereby improving affordability and reducing foreclosures.

The program originally allowed homeowners to refinance their mortgages up to a loan-to-value of 125%, meaning if your home was worth $100,000, the max loan amount you could receive under the program would be $125,000.

They quickly realized that these max LTVs weren’t adequate because homeowners were in such deep trouble. So they decided to let borrowers refinance with no maximum LTV ratio, meaning even the most underwater homeowner could snag a lower mortgage rate.

See the details of HARP Phase II for more on that.

But like a typical mortgage refinance, there are underwriting guidelines to ensure only the right homeowners qualify.

Qualifying for a Negative Equity Refinance

- You typically need to be current on mortgage payments

- With no more than one late payment in past 12 months

- Available for all property types

- For loans originated prior to the current crisis

To be eligible, you must be current on your mortgage payments, meaning no 30-day+ lates in the past six months, and no more than one over the past 12 months.

The home must be either an owner-occupied 1-4 unit primary residence, a 1-unit second home, or a 1-4 unit investment property.

Additionally, your existing home loan must be owned by Fannie Mae or Freddie Mac.

[How do I know if Fannie or Freddie own my mortgage?]

The LTV ratio must be greater than 80% as well, otherwise you could just refinance your mortgage via traditional channels.

Lastly, your home loan must have been originated (funded) on or before May 31st, 2009.

If you meet the qualifications above, you can contact your mortgage lender or loan servicer to get the HARP process rolling before the low mortgage rates disappear.

You can actually contact any bank or lender that offers HARP loans and comparison shop like typical mortgages. And use a refinance calculator to determine the savings as you would a normal refinance.

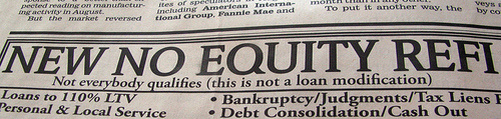

If your loan isn’t owned by Fannie and Freddie, speak with your loan servicer and/or mortgage lender about special refinance programs for those in negative equity positions. Many individual lenders have proprietary programs designed for underwater borrowers, so be sure you don’t miss out.

You may also be able to qualify for a loan modification even if you owe more than your home is currently worth.

Negative Equity FHA Borrowers Are Also in Luck

If you happen to have an FHA loan, you may also be eligible for a refinance if you are in a negative equity position.

The FHA offers a very easy-to-use streamline refinance option, which is available to existing FHA borrowers who are current (in good standing) on their loans.

There is no appraisal requirement, so essentially no LTV constraints and no appraisal fees! Additionally, you can take advantage of lower mortgage insurance premiums.

Don’t confuse this program with the FHA Short Refinance program, which is only available to borrowers whose loan is NOT owned or guaranteed by the FHA, VA, USDA, or Fannie and Freddie.

Read more: Learn about a short refinance, which some lenders will allow if you’re short on home equity.

- Rocket Mortgage Completes Redfin Takeover, Offers $6,000 Home Buyer Credit - July 1, 2025

- Mortgage Rates Quietly Fall to Lows of 2025 - June 30, 2025

- Trump Wants Interest Rates Cut to 1%. What Would That Mean for Mortgage Rates? - June 30, 2025

can you tell me if the federal government has a law regarding how much escrow a mtg. co must have in your acct? our boa loan was sold to nation star mtg last year and now even though nothing has changed (taxes/insurance) they have said they are required by law to have enough excess in the escrow acct to make two monthly payments and that we were short on that last year by $400 so they are taking an additional $63 a month for escrow. we weren’t short on paying taxes and insurance, they said we were short on what the feds say we have to have in there and we owe them that. the $63 a month comes to $756 a year! this is way more than double one monthly payment. can they do this? do the feds even tell them how much we must have? this fly by night mtg co services from the Philippines i read! please help me understand how they can do this. thank you!

J Sohn,

This is pretty common and has to do with rising taxes/insurance and perhaps an assessment that you needed more money set aside in your escrow account.

I’m new to the whole mortgage industry and I hope this isn’t a stupid question. I’m confused as to what the benefit of refinancing an underwater mortgage. With the example above, if the home is only worth $100,000, why get a loan of $125,000? Doesn’t that mean you now have an even higher loan to pay off when your home is already worth so low?

Binh,

Just because a property value dips for a moment in time doesn’t mean the homeowner can/should stop paying the mortgage. You would refinance to get a lower interest rate and the loan amount could be higher than the current value because it originally sold for more. Ideally over time the homeowner gets back above water once values bounce back and they have a lower payment thanks to the refi.