When shopping for a mortgage, it’s very important to pick a suitable loan product for your unique situation.

Lately, I’ve been discussing loan programs beyond the 30-year fixed, now that interest rates on fixed-rate mortgages are no longer favorable.

Today, we’ll compare two popular loan programs, the “30-year fixed mortgage vs. the 7-year ARM.”

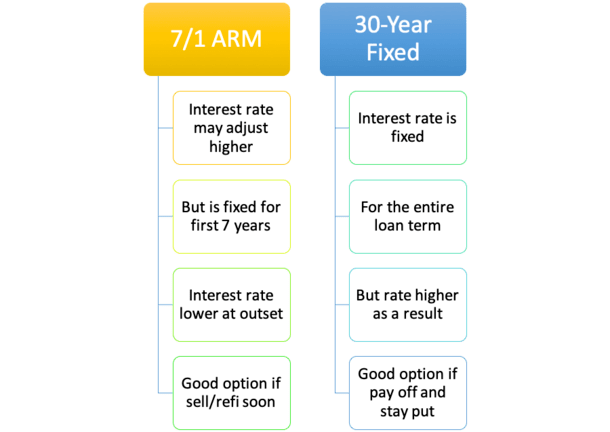

Everyone is familiar with the traditional 30-year fixed – it’s a home loan with a 30-year duration and an interest rate that never adjusts the entire loan term. Pretty simple, right?

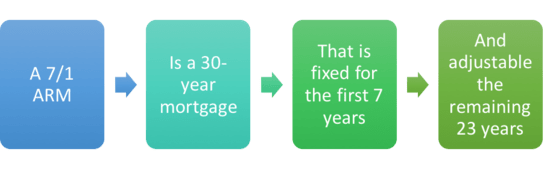

But what about the 7-year ARM, or more specifically, the 7/1 ARM? It’s an adjustable-rate mortgage and a fixed-rate mortgage, all rolled into one. Sounds a little bit more complicated…

How the 7/1 ARM Works

- You get a fixed interest rate for the first seven years of the loan

- After that the rate becomes annually adjustable for the remaining 23 years of the 30-year loan term

- Many borrowers don’t keep their mortgage/home that long so you may never actually face a rate adjustment

- It’s an option to consider alongside the more popular 30-year fixed

A 7/1 ARM is an adjustable-rate mortgage with a 30-year term that features a fixed interest rate for the first seven years and a variable rate for the remaining 23 years.

Let’s break it down. During the first seven years of the loan term, the mortgage rate is fixed, meaning it won’t change from month-to-month, or even year-to-year.

So if the starting interest rate is 3%, that’s where it will remain until it’s first adjustment in month 85.

For all intents and purposes, the loan program offers borrowers fixed rates for a very lengthy 84 months.

During the remaining 23 years, the rate is adjustable, and can change just once per year. That’s where the number “1” in 7/1 ARM comes in.

This makes the 7-year ARM a so-called “hybrid” adjustable-rate mortgage, which is actually good news.

You essentially get the best of both worlds. A lower interest rate thanks to it being an ARM, and a long period where that rate won’t change.

It affords you two additional years of fixed payments when compared to the 5/1 ARM. And those 24 extra months might come in handy…

You Might Also Come Across the 7/6 ARM

Lately, more mortgage lenders have been pitching ARMs that adjust every six months instead of annually.

So you may come across a “7/6 ARM,” which as the name implies is fixed for the first seven years and then adjusts twice each year (every six months) thereafter.

The good news is it’s not all that different than the 7/1 ARM. You still get the seven years of fixed rate goodness, which is arguably the most important feature.

Then you’re subject to a rate adjustment every six months. If you still have your ARM at that point, you can explore a refinance if rates are favorable.

Otherwise, you’ll need to contend with more adjustments, though it should be noted that rates can move both up and down.

If you prefer one over the other, shop accordingly to see which lenders offer the 7/1 ARM vs. the 7/6 ARM, or vice versa.

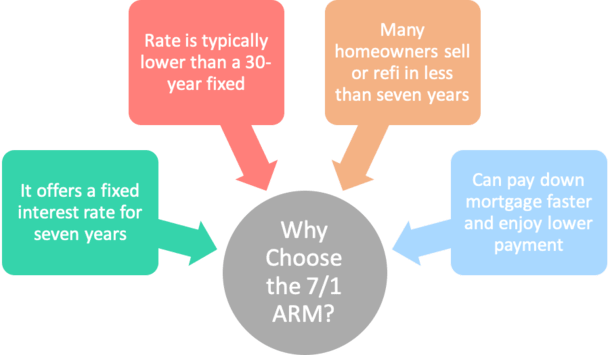

Why Choose the 7/1 ARM?

- You can obtain a lower interest rate (and monthly payment)

- Relative to other fixed-rate mortgage options that might be available

- This loan type features a fixed interest rate for a full seven years

- Meaning you may hold a fixed-rate mortgage for as long as you own your home or until you refinance

You probably don’t want your mortgage rate (and mortgage payment) to change all the time, especially if your rate increases, which is probably the likelier outcome.

With the 7/1 ARM, you get mortgage rate stability for a full seven years before even having to worry about the first rate adjustment.

And because most homeowners either sell or refinance before that time, it could prove to be a good choice for those looking for a discount.

That’s right, 7/1 ARM mortgage rates are cheaper than the 30-year fixed, or at least they should be.

By cheaper, I mean it comes with a lower interest rate than the 30-year fixed, which equates to a lower monthly mortgage payment for the first 84 months!

As noted, most homeowners don’t keep their home loans that long anyway, so there’s a decent chance the borrower will never see that first adjustment, yet still enjoy that low rate month after month for years.

How Much Lower Are 7/1 ARM Rates?

At the time of this writing, mortgage rates on the 7-year ARM are being offered at around 5.625%, while the typical rate on a 30-year fixed is about 6%.

[What mortgage rate can I expect?]

That’s an OK rate spread, especially after a long period where fixed-rate mortgages outperformed ARMs.

Over the past several years, fixed interest rates were super low because the Fed pledged to buy up long-term fixed-rate mortgage securities, driving rates down.

As such, ARMs weren’t offering much of a discount (if any) and often weren’t even worth looking into in most cases.

But in normal times, which we’re starting to return to, you might find an even wider spread between the two products.

For example, a few years back the 7-year ARM averaged 3.64%, while the average rate on a 30-year fixed was 4.69%.

That resulted in a monthly payment difference of $122.28 a month, $1,467 per year, and over $10,000 over the first seven years on a $200,000 loan amount. Not bad, eh?

Let’s look at the math:

Loan amount: $200,000

30-year fixed monthly payment: $1,036.07

7-year ARM monthly payment: $913.79

Not only would you save long-term, but you’d also save monthly, meaning you could put that extra money to good use somewhere else, such as in a more liquid investment.

Or simply set it aside to pay other bills (like high-interest credit cards) or build up an emergency fund.

The lower rate would also pay down your principal balance faster, meaning you’d accrue home equity faster.

Are the Lower 7/1 ARM Rates Worth the Risk?

- You have to weigh the risk and reward of the 7/1 ARM

- While you receive a discounted interest rate for a lengthy seven years

- Perhaps .50% to .625% lower than the 30-year fixed during normal times

- Consider the risk of the rate adjusting higher in year 8 and beyond unless you sell your home or refinance before that time

Now let’s talk about 7/1 ARM rates, which are typically cheaper than the 30-year fixed, but how much depends on the current rate environment.

If you actually plan on staying in your home and paying off your mortgage, you face the possibility of an interest rate reset (higher, or lower) in the future.

And you don’t want to get caught out if mortgage rates surge over the next seven years, especially if you can’t sell your home or don’t want to.

However, if you’re like many Americans, who sell or refinance within seven years, the loan program could make a lot of sense, assuming it’s a good time to sell or refinance rates are attractive at some point over those 84 months.

Compare Rates/Costs to the 30-Year Fixed. Do the Math

Just be sure to do the math on both scenarios before committing to either of these loan programs.

Sometimes the rate spread between seven-year ARM rates and the 30-year fixed isn’t that wide.

At the moment, the spread is beginning to widen, making adjustable-rate mortgages favorable again.

However, you do need to put in more to shop around because ARM rates can vary a lot more from bank to bank than fixed rates.

If you put in the legwork, you may find a bank or lender willing to offer a more substantial discount.

For example, First Republic Bank does most of its volume in ARMs, and could offer a wider spread versus the competition.

Regardless, this spread can and will fluctuate over time, so always take the time to consider that when making a decision between the two loan programs.

Obviously, the upside is diminished and it gets riskier if the two loan programs are pricing similarly.

Make Sure You Can Afford the 7/1 ARM After It Resets

- It might be wise to look at the worst-case scenario

- Which is the maximum interest rate your loan can adjust to

- This ensures you can handle the larger monthly mortgage payments

- Assuming you don’t sell or refinance or are unable to and your rate adjusts significantly higher

Also note that you should be able to afford the fully-indexed rate on a mortgage ARM, should it adjust higher.

After those seven years are up, the interest rate will be calculated using the margin and the index rate (such as SOFR) tied to the loan. This rate could be considerably higher than what you were paying.

In other words, expect and plan for rate increases in the future and make sure you can absorb them if for some reason you don’t sell your home or refinance your mortgage first.

If a rate adjustment isn’t within your budget, or won’t be in the future when it adjusts, you may want to pay it safe with a fixed-rate mortgage instead of the 7/1 ARM.

Believe it or not, seven years can go by pretty fast.

Refinancing Your 7-Year ARM in the Future

The good news is even if mortgage rates are higher seven years after you take out your loan, you’ll still be pretty far ahead from all the savings realized during that time.

You’ll have a smaller outstanding loan amount thanks to more of your monthly payment going toward the principal balance and you’ll have saved a ton on interest.

So even if refinance rates are higher in the future, or you simply let it ride with a rate adjustment, you may still come out ahead, at least for a little while.

If nothing else, the savings during the first seven years may give you breathing room to pay more in the future, or refinance at more attractive terms.

In summary, the 7-year ARM might not be for the faint of heart, whereas a 30-year fixed is pretty straightforward and stress-free. And that’s why you pay more for it.

If you’re certain you won’t be staying in a property for more than five or so years, it could be a solid alternative and a big money saver if spreads are wide.

To know for sure, use a mortgage calculator to compare the costs of each loan program over your expected tenure in the property.

7/1 ARM Pros and Cons

The Good

- You get a fixed interest rate for an entire seven years (84 months!)

- The rate is typically much lower than a 30-year fixed

- More of each monthly payment will go toward the principal balance instead of interest

- Most homeowners move or refinance in less time than that

- So you can enjoy a lower mortgage rate without worrying about a rate adjustment

The Bad

- It’s an ARM that can adjust higher after seven years

- Monthly payments may become much more expensive if you hold onto it

- The interest rate discount may not be worth the risk of the rate adjustment

- More stress if you hold the mortgage anywhere near seven years

- Could be stuck with the loan if unable to sell/refinance once it becomes adjustable

Read more: 30-year fixed vs. 15-year fixed.