Mortgage Q&A: “What mortgage rate can I expect?”

The thing with mortgage rates is that they can vary greatly depending on a number of market forces and borrower-specific factors.

That’s why it’s impossible to just throw a random interest rate out there such as 5.99% or 6.99%.

Sure, a handful of borrowers may qualify for a mortgage rate like that. But there will be many others who qualify at a higher rate, assuming they even get approved to begin with.

To get a better idea, answer some questions about yourself and the subject property.

Your Default Risk Determines Your Mortgage Rate

- First you need to know what type of borrower you are (excellent credit, bad credit, etc.)

- And what type of property you’re buying or refinancing with what down payment

- Once you know the level of risk you present to the lender you can get a better idea of mortgage rate expectations

- Those who are deemed lower risk with be able to obtain the lowest market rates available

This is one of the most common mortgage questions I get. Everyone wants to know what their mortgage rate will be.

As noted, it’s hard to pinpoint, but we can arrive at some good estimates by learning more about the loan scenario.

In fact, this is exactly how a mortgage lender or mortgage broker approaches it. They generate your loan scenario by asking basic questions.

Once they know your credit score, occupancy/property type, and transaction type, they’ll have a clearer picture.

For example, if you want to refinance a second home with a 660 credit score and a loan-to-value ratio of 90%, your mortgage rate will be much higher than those rates you see advertised.

Meanwhile, a borrower with an 800 credit score who purchases an owner-occupied, single family residence with 30% down could obtain a much lower rate.

This all has to do with risk. Clearly the second borrower in my example above is less of a default risk.

They are putting down a lot more money, have a much better credit score, and plan to live in the property full time.

Even if our second borrower missed a few mortgage payments and landed in foreclosure, the bank or lender who issued the mortgage is safe because the borrower put so much money down (there’s plenty of home equity).

This wouldn’t be the case for a borrower who obtains a home with 100% financing and quickly winds up in foreclosure.

And that’s why mortgage rates are priced accordingly to compensate for different levels of risk. If you take a moment to think about it, it makes perfect sense.

Will I Get a Low, Average, or High Mortgage Rate?

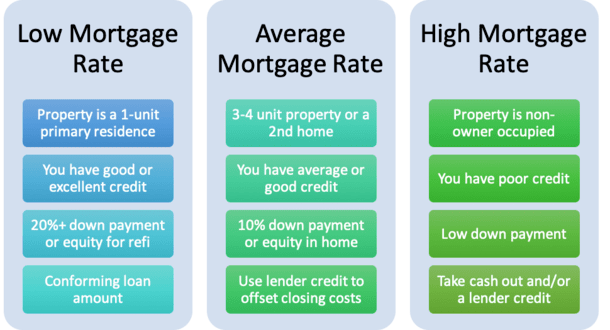

While the chart above attempts to sum up how mortgage rates vary based on certain risk factors, it is often a combination of risk factors that dictate your rate.

So it may be possible to get a low mortgage rate with a low down payment, assuming you have excellent credit and are financing a single-family home you intend to occupy.

And it may be possible to get stuck with a high mortgage rate even if you have 20% down and are financing a primary residence, assuming you’ve got poor credit.

But the point is the more high-risk factors you present to the lender, the higher your interest rate, all else being equal.

The same goes for those seeking a cash out refinance, or using a lender credit to offset closing costs, both of which will increase your interest rate.

Simply put, cash out refis always come with higher interest rates, though not tremendously higher than a purchase loan or rate and term refinance depending on the other loan attributes.

And if you pay less at closing, those costs will need to be absorbed via a higher mortgage rate.

Conversely, if you pay a lot of money at closing out of your pocket, and even decide to pay discount points, you can get the lowest mortgage rate possible.

The main takeaway is to try to tick all the good boxes to ensure you qualify for the lowest mortgage rates. Then take the time to shop around for your home loan!

It all has to do with mortgage pricing adjustments, which I’ve written about in great detail.

Factors that affect your mortgage rate:

– Loan purpose (home purchase or refinance)

– Loan amount (conforming or jumbo)

– Credit score (what credit score do you need to get a mortgage?)

– Loan-to-value ratio (down payment or amount of equity in home)

– Documentation type (full doc, stated income, etc.)

– Property type (single-family residence, condo)

– Occupancy type (owner-occupied, second home, investment property)

– Debt-to-income ratio (a high DTI could come with a pricing hit)

All these factors, and perhaps others imposed by specific banks and mortgage lenders, can move your mortgage rate significantly.

There are also additional pricing adjustments if it’s a cash out refinance.

You also need to consider closing costs, which if paid out-of-pocket should result in a lower mortgage rate. The same goes for paying discount points.

But if you use a lender credit to avoid these costs, otherwise known as a no cost refinance, expect a higher mortgage rate.

Advertised Mortgage Rates Assume the Best of You

- Don’t get too excited about the mortgage rates you see advertised

- They make a lot of GOOD assumptions about their hypothetical borrowers

- Like excellent credit, large down payment, owner-occupied property, and so on

- If that describes you, great, but if not, expect a higher mortgage rate

When it comes down to it, most mortgage rates you see on TV, the Internet, or anywhere else are just marketing rates, meaning they’re simply being utilized to get you in the door.

Kind of like that one car the dealer advertises in the newspaper to get you down to the lot. By the time you get there, it’s “sold.” And the price they offer you is much higher…for the wrong color.

Once you present your very unique loan scenario to the mortgage broker or loan officer handling your loan application, your mortgage rate may be nowhere close to that ad you saw.

So don’t be surprised, just know that the less risk you present the lender, the lower your mortgage rate should be (risk-based pricing).

Again, the less risky your loan, the lower your mortgage rate should be. I say should because you can still get ripped off by a shady lender if you’re not careful.

If you use a little common sense, you’ll quickly be able to determine why your mortgage rate should be higher, lower, or just in line with the advertised rate.

Tip: Be mindful of unscrupulous lenders who may convince you that your loan is more risky than it appears as a means to charge you a higher interest rate so they can collect a larger commission!

To avoid getting a raw deal, shop your home loan with multiple lenders so you have a better idea of where pricing should be.

Read more: What mortgage rate can I get with my credit score?