It’s official. United Wholesale Mortgage (UWM) is the nation’s largest mortgage lender.

The Pontiac, Michigan-based wholesale lender took the top spot for all of 2023 after easily beating out former #1 lender Rocket Mortgage.

In total, the company funded $108.3 billion in home loans during the year, compared to Rocket’s $78.7 billion tally.

Crosstown rival Rocket, based in Detroit, had been the nation’s top mortgage lender since 2018.

Prior to that, Wells Fargo was the top dog, though the San Francisco bank has steadily shrunk its mortgage footprint over the years. Still, they remain in third place.

UWM Generated the Most Loan Volume of Any Mortgage Lender for All of 2023

Similar to their predecessors, UWM was able to beat out the rest of the competition in a quarter or two before getting to the top of the pile.

But they finally mustered outright victory for an entire year in 2023, without even needing their fourth quarter production of $24.4 billion. That’s pretty impressive.

Of course, it wasn’t all good news. The company still saw production fall year-over-year from $127.3 billion in 2022.

And they lost money last year as well. UWM recorded a net loss of $69.8 million in 2023, compared to $931.9 million of net income in 2022.

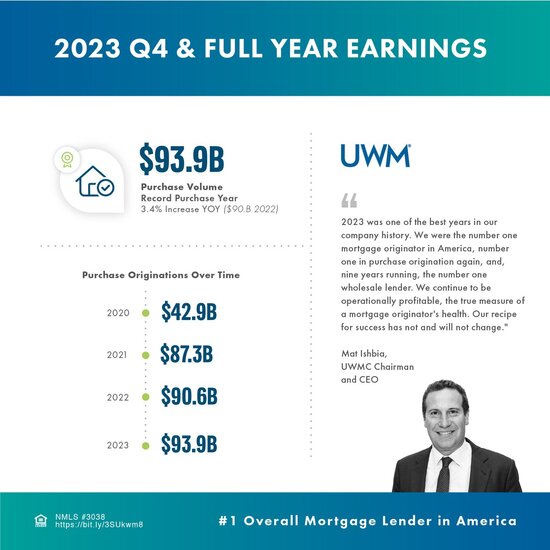

Though UWM Chairman and CEO Mat Ishbia said they are “operationally profitable,” and that the loss was the result of MSR markdowns related to interest rate movements.

Given how difficult of a year it was for the mortgage industry, they’re probably happy to be where they’re at.

They also saw annual gains in the jumbo loan and non-qualified mortgage product category, which includes newly-launched home equity lines of credit (HELOCs).

UWM Claims Top Spot Despite Being a Wholesale-Only Lender

What is perhaps more remarkable about UWM’s ascent to the top is the fact that they only work in the wholesale channel.

This means they don’t have any retail operations, and instead rely upon mortgage brokers to bring business to them.

So if you want to work with them, you have to go through a mortgage broker first.

Meanwhile, many other mortgage companies, including Rocket, have both retail and wholesale operations.

So this speaks to the tremendous push UWM has made to get to #1, and also the rise in the mortgage broker share in general.

Back in the early 2000s, mortgage brokers were blamed for the housing crisis that transpired. Today, it seems they are back in full force.

And it’s not just mortgage refinancing that got them to peak position. It’s mostly purchase lending, which is typically more personal and close to home.

Ishbia also noted that the company was the number one wholesale lender for the ninth year straight.

In case you weren’t aware, he also recently purchased the Phoenix Suns and Mercury.

UWM Is the Nation’s Leading Home Purchase Lender Too

Lately, the mortgage market has been decidedly purchase-driven. With mortgage rates closer to 7% than 3%, very few borrowers are refinancing.

Despite this shift, UWM was able to capture a record $93.9 billion in home purchase loans during 2023.

This total alone was more than enough to beat out the second largest lender, excluding their refinance business.

That meant their purchase business did much of the heavy lifting, accounting for nearly 87% of overall loan origination volume.

And such business increased from $90.6 billion in 2022, $87.3 billion in 2021, and $42.9 billion in 2020.

Meanwhile, mortgage refinance volume totaled just $14.4 billion during the year, down from $36.5 billion a year earlier.

Assuming mortgage rates improve going forward, UWM could see their production increase markedly.

With regard to 2024, they anticipate first quarter production to range from $22 to $28 billion, compared to $24 billion in Q1 2023.

So it sounds like they’re going to stay atop the rankings for a while, though if Chase wanted to, it could probably make a push as well.

I should have a complete list of the top 2023 mortgage lenders soon.