If you’re currently the proud owner of a mortgage, you’ve undoubtedly heard of a cash-out refinance, one that allows you to tap into your home equity.

They were quite popular during the housing boom, when homeowners serially refinanced and simultaneously pulled “cash” from their homes while property values skyrocketed.

You may have also heard the phrase, “using homes as ATM machines.”

Well, the downside to this seemingly lucrative practice was that their mortgage balances also grew as they refinanced.

You don’t just get free money. If you refinance and pull cash out, your loan amount grows, no ifs, ands or buts about it.

[Do mortgage payments increase?]

Did You Run Out of Equity?

- Many borrowers serially refinanced during the housing boom

- And zapped all their home equity in the process

- At the same time home prices also dropped rapidly

- Making it impossible to refinance via traditional channels

So when the housing appreciation party came to a sudden end, many of these homeowners became the proud owners of underwater mortgages – that is, they owed more on their mortgages than their properties were worth.

Unfortunately, you typically can’t even do a rate and term refinance if you’re underwater on your mortgage, meaning those record low mortgage rates are out of reach for many.

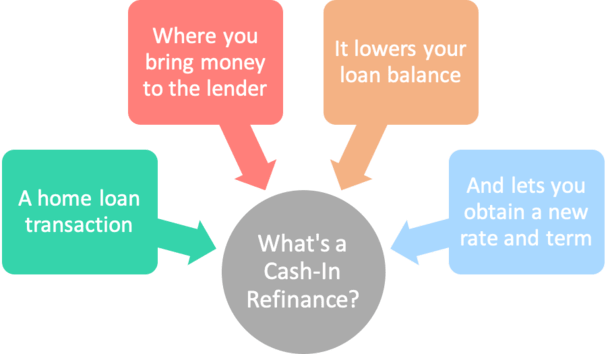

Enter the “cash-in refinance.”

Put simply, a cash-in refinance is the opposite of a cash-out refinance. When homeowners apply for a cash-in refinance, they bring money to the closing table to lower their mortgage balance.

Let’s look at an example of a cash-in refinance:

Home value: $500,000

Mortgage balance: $510,000

Maximum loan amount: $475,000 (95% LTV)

In this all-too-common scenario, the homeowner is underwater and must come up with $35,000 (plus any closing costs) to accomplish the cash-in refinance.

That would put their loan-to-value ratio (LTV) at 95%, which might be the max allowed.

Assuming the borrower has the funds available, they could bring in this money to get the loan amount down to an acceptable level.

Why a Cash-In Refinance?

- To lower your loan amount to an acceptable level

- That is at/below the max LTV allowed by the lender

- Or to keep it at/below a certain threshold like 80% LTV

- To avoid mortgage insurance and obtain a lower interest rate

- Also to stay at/below the conforming loan limit

Borrowers may need a cash-in refinance for several different reasons.

Probably the most common reason of late has to do with the underwater homeowners I just mentioned.

Those short on home equity pretty much have no choice but to bring cash in to qualify for the refinance in question.

In other words, they won’t qualify unless they pay down their mortgage balance to a suitable level.

For some, this could be 125% LTV, which was the highest level allowed by some special government mortgage refinancing programs such as HARP before it was later expanded to all LTVs.

[Can you refinance with negative equity?]

Traditionally, this might be any level below 100% LTV, which is the typical maximum allowed by conventional mortgage lenders.

However, cash-in refinances aren’t just for the distressed homeowner. Borrowers can also utilize them in order to lower their loan balances so they can qualify for a lower mortgage rate.

An example would be a homeowner whose outstanding loan balance puts them at say 90% LTV.

If they bring in another 10%, their LTV drops to 80%, pushing their interest rate lower thanks to more favorable pricing adjustments. At the same time, they avoid the need for mortgage insurance.

Bringing in cash will also lower your loan amount, which equates to a lower monthly mortgage payment and reduce the amount of interest you pay throughout the life of the loan.

So it’s a triple win: smaller loan amount, lower interest rate, and no MI!

Another reason to bring in cash is to ensure the conforming loan limit isn’t exceeded, thereby avoiding jumbo loan pricing.

It can be more difficult to obtain a jumbo home loan, or the pricing may just be less favorable, so a borrower may choose this type of refinance to keep costs down and improve approval chances.

Why a Cash-In Refinance May Not Always Be the Best Move

- Consider the alternatives for your cash

- You might be able to earn more elsewhere

- Such as in a retirement account or another investment

- Remember to diversify your assets and maintain liquidity

All of the above sounds pretty awesome, right? Well, unless you have to bring in cash to qualify for the refinance, it might not always be the best move.

If your money will earn more in an investment account, paying down your mortgage early won’t necessarily be the right choice, especially with mortgage interest rates so low at the moment.

Additionally, if home prices slip further or you need cash for an emergency, having it locked up in an illiquid investment won’t do you much good.

Ironically, the very homeowners who pulled cash out over the past decade have probably taken advantage of cash in refinances recently as well.

Go figure.

Read more: What is a short refinance?

This was incredibly helpful. I’ve been trying to figure out the difference between the two ever since I heard the terms, and after searching for a while, this was the first page that offered a simple explanation that answered my questions. Thanks a ton.