A “fixed-rate mortgage” is the most basic and uncomplicated home loan available to borrowers today.

It is far and away the most popular choice for homeowners because of its conservative and affordable nature.

Something like 90% of home buyers (and existing homeowners who refinance) go with a fixed-rate loan.

The most common variety is the 30-year fixed, which features a term long enough to keep monthly payments relatively inexpensive.

What Is a Fixed-Rate Mortgage?

A fixed-rate mortgage is a home loan with an interest rate that does not change during the entire duration of the loan term, which is typically 30 years.

This means borrowers don’t have to worry about their mortgage rates adjusting higher, which would cause their monthly payments to increase.

However, 30-year mortgage rates do come at a premium relative to other loan types in exchange for this assurance.

Still, given their predictability and relatively low rates, they remain far and away the most popular type of mortgage.

Let’s learn more about the features of a fixed-rate mortgage, along with key advantages and disadvantages.

Jump to fixed-rate mortgage topics:

– Fixed Mortgage Rates Are More Expensive

– How Much Cheaper Is an ARM?

– Are Fixed-Rate Mortgages a Good Idea?

– Why Did My Mortgage Go Up If I Have a Fixed-Rate?

– Types of Fixed-Rate Mortgages Available

– Fixed Mortgages with Interest-Only Options

– Fixed-Rate Mortgage Benefits

– Fixed-Rate Mortgage Cons

– Can I Refinance a Fixed-Rate Mortgage

Fixed-Rate Mortgages Are Easy to Understand and Surprise-Free

- Fixed-rate home loans feature interest rates that never adjust

- This means the interest rate stays the same the entire loan term

- Homeowners don’t have to worry about rising monthly payments

- But they pay a premium for this benefit via a higher rate at the outset

First off, fixed-rate mortgages do not have associated mortgage indexes, margins, or caps because they are not variable-rate loans.

It’s basically a set-it-and-forget-it loan program that’s easy to understand, unlike mortgages with adjustable rates.

Another key characteristic of the fixed-rate mortgage is that monthly principal and interest mortgage payments remain constant throughout the life of the loan, to the very last month when the loan is finally paid off.

Imagine if your monthly payment on a 30-year fixed-rate mortgage was $1,000. Even if mortgage rates rise during that time, your payment will not change.

So you could lock in a rate of 3%, watch mortgage rates rise to 8%, and continue to enjoy your 3% rate until your loan is paid off.

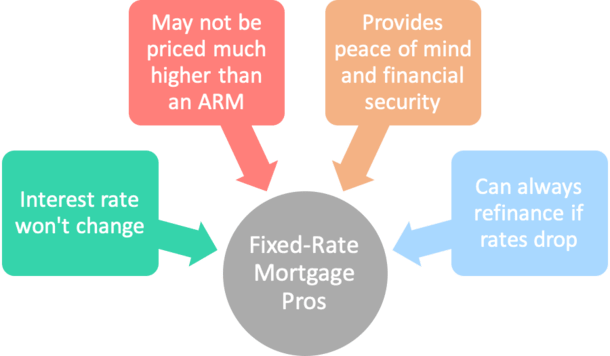

Conversely, if rates happen to go down, you have the option to refinance to a lower interest rate as well.

In other words, you get the best of both worlds with a fixed-rate loan, and there aren’t too many surprises.

This makes it easier for the homeowner to sleep at night.

Of course, that certainty does come at a cost, namely, a higher mortgage rate relative to adjustable-rate options.

30-Year Fixed Mortgage Rates Are the Most Expensive Option

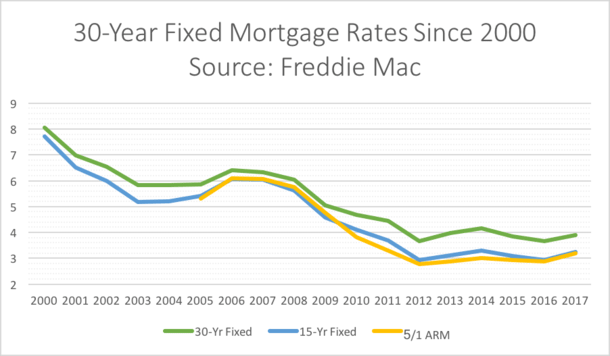

The chart above displays average 30-year mortgage rates since the year 2000, per Freddie Mac data.

While the 30-year fixed is definitely the most popular mortgage out there, it also tends to be the most expensive other than the 40-year mortgage, which isn’t too common these days.

In a nutshell, you get saddled with a higher mortgage rate because the lender is taking a risk by letting you lock in today’s low rates for the next three decades.

They know mortgage interest rates can go up during that time, so they price some of that risk into the rate upfront.

However, a 30-year fixed might not cost much more than a 5/1 ARM, depending on the rate environment at the time you’re shopping for a loan.

So despite being slightly more expensive, it can still be the right choice.

How Much Cheaper Is an Adjustable-Rate Loan?

| $400,000 Loan Amount | 5/1 ARM | 30-Year Fixed |

| Mortgage Rate | 6.00% | 6.75% |

| Monthly P&I Payment | $2,398.20 | $2,594.39 |

| Total Cost Over 60 Months | $143,892.00 | $155,663.40 |

| Remaining Balance After 60 Months | $372,217.57 | $375,502.97 |

| Total Savings | $15,056.80 |

Today, a 30-year fixed might be offered at around 6.75%, while a comparable 5/1 ARM could be available for 6%.

This 0.75% spread is the cost of securing that fixed rate for 30 years. Or the discount of going with the ARM instead.

On a $400,000 loan amount, we’re talking a difference of about $200 per month in mortgage payment.

For some folks, that’s a small price to pay for a surprise-free mortgage. For others, it means leaving money on the table and paying more than necessary.

That higher rate also means your mortgage balance is paid off slightly slower than the low-rate option, which could be important if you’re trying to build home equity and eventually refinance.

It’s very important to determine what type of loan is right for you early on in the home buying process, instead of having your loan officer influence that decision.

While the 30-year fixed is definitely the default choice, it’s not necessarily the right fit for all borrowers. So do your research beforehand!

Are Fixed-Rate Mortgages a Good Idea?

As you can see, a 30-year fixed is actually the more expensive option relative to an adjustable-rate mortgage.

Our hypothetical borrower would be roughly $15,000 better off if they went with an ARM instead of a fixed-rate loan.

But that’s not the whole story. We need to know what happens after year five. Does the ARM reset significantly higher? Does it become unaffordable?

Is the homeowner forced to refinance, even if rates aren’t low? This scenario played out in 2023 when rates increased from around 3% to 8% in a matter of months.

So while you might pay more initially, long term the fixed loan could still be the winner. This is especially true if you’re unable to refinance. Or if rates stay elevated after you take out your loan.

Of course, things can go the other way too. And if you sell your home before or around the five year mark, youd still come out ahead.

Ultimately, it all boils down to certainty and peace of mind with a fixed-rate loan. And you can still refinance a fixed-rate mortgage if rates improve.

Why Did My Mortgage Go Up If I Have a Fixed-Rate?

It’s important to remember that the fixed interest rate only applies to the mortgage itself. This includes the principal and interest portion of the payment only.

But there are also property taxes and homeowners insurance (and possibly mortgage insurance too). Together, this is known as PITI, or principal, interest, taxes, and insurance.

If your property taxes or insurance bill increase, your monthly payment can increase also, assuming your mortgage is impounded.

Those who pay a portion of taxes and insurance each month to their loan servicer might see their mortgage go up despite the fixed interest rate.

The good news is it’s generally a negligible amount, though lately some homeowners have seen much large insurance premiums. Or property tax assessments. But this is unavoidable regardless of loan type.

Types of Fixed-Rate Mortgages

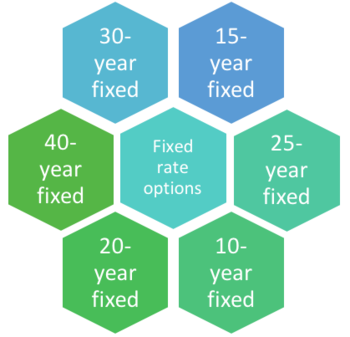

The most common type of fixed-rate mortgage is the 30-year fixed, which amortizes over thirty years.

The majority of early payments go toward interest, and the bulk of later payments go toward principal.

It’s basically the gold standard because it’s cheap and the loan term isn’t excessively long.

The next most popular type of fixed-rate mortgage is the 15-year fixed, which amortizes over fifteen years.

It bumps up monthly mortgage payments significantly, but reduces the amount of interest paid throughout the duration of the loan considerably.

The 15-year fixed has the potential to save you a ton of money and build home equity fast.

However, it’s often not affordable for many first-time home buyers (or even existing homeowners) because monthly payments are significantly higher.

If you want to compare the costs and savings, grab a mortgage calculator and prepare to be shocked at how much borrowers can save over the life of the loan with a 15-year fixed.

Many banks and mortgage lenders also offer 10-, 20-, 25-year loan terms. Some even offer 40-year loans and 50-year loans as well, though they are far less popular and widespread.

You may also be able to choose your own term, via programs like Quicken’s Yourgage, and through similar programs offered by other lenders.

If you want a certain term, just let them know and they might be able to accommodate you.

A shorter term means a higher payment, but it also equates to a lot less interest and a home that is free and clear that much faster, assuming that’s one of your financial goals.

Fixed Mortgages with Interest-Only Options

- Some fixed-rate home loans come with an interest-only option

- This allows borrowers to make just the interest portion of the payment each month

- Without worrying about their interest rate adjusting higher

- But this can make future payments unaffordable once the repayment period begins

Some fixed-rate mortgages also feature interest-only periods, which allow homeowners to make interest-only mortgage payments during the first five to ten years of the loan term.

Once that period is over, the loan will recast to account for any reduced payments made during that period.

In other words, monthly payments after the interest-only period expires will be higher to compensate for lower payments made early on.

And you typically need to pay extra for this IO option, which can increase closing costs.

However, the mortgage is still considered “fixed” because the rate is not subject to change. It is simply recalculated to reflect the remaining number of months and the remaining mortgage balance.

Fixed-Rate Mortgage Benefits

- Interest rate stability (your mortgage rate won’t change!)

- Allows you to sleep at night instead of worrying about rising rates

- Can take advantage of cheap money over time as inflation does its thing

- Just be sure to pay attention to mortgage rates regardless

- If they drop significantly it could make sense to refinance a fixed-rate loan too

Fixed-rate mortgages are beneficial for a number of reasons, though the fact that your mortgage payment will never change is clearly paramount.

If interest rates rise, homeowners with adjustable-rate mortgages will suffer the consequences of higher monthly mortgage payments.

Meanwhile, fixed-rate borrowers can rest assured that their payments will not change under any circumstances.

Borrowers with fixed loans won’t need to worry too much about where the market is headed either, though it’s wise to monitor interest rates in case a sizable interest rate drop makes it favorable to refinance.

But generally, it’s a pretty stress-free loan choice, and one that’s favored by many government programs (FHA loans, VA loans) for its stability and clear-cut nature.

Simply put, the fixed mortgage is a good choice for the borrower who actually wants to pay off their mortgage, and plans to stay in the home (and with the mortgage) for the foreseeable future.

Tip: It could also be a good choice for an owner-occupied property you plan to rent out once you move. That way you can secure cheap financing upfront for the long-term.

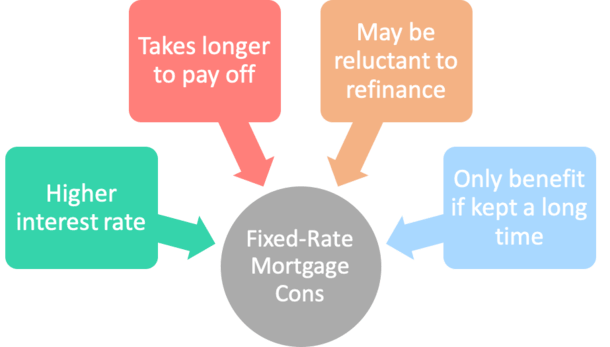

Fixed-Rate Mortgage Cons

- The biggest downside is the higher interest rate

- This means you pay more money each month

- It also means you own less of your house because more of the payment goes toward interest

- You may also miss opportunities to refinance if you’re afraid to check out other loan programs

- Only beneficial if you plan to keep the mortgage and property for a long time

As mentioned, the only real negative aspect of a 30-year fixed-rate mortgage is the higher interest rate.

Although, these days many fixed mortgages price fairly close to ARM rates, so it does depend on the spread at the time.

Typically, homeowners pay a premium to lock in a fixed mortgage rate, whereas adjustable-rate mortgages may be discounted, especially early on. That means you get a lower rate and payment.

For example, a 30-year fixed mortgage rate may be one percentage point higher than say a 7/6 ARM.

But the borrower who goes with the fixed loan is banking on payment stability in exchange for the higher upfront cost.

The homeowner with the ARM is essentially taking a risk that rates won’t rise in the future, or that they’ll sell/refi before that happens.

[Fixed mortgage vs adjustable-rate mortgage]

You May Still Want to Refinance Your Fixed-Rate Mortgage

The good news is you are able to refinance a fixed-rate mortgage.

However, one small negative is the idea that homeowners will fail to refinance when a good opportunity comes around.

Because they’re so obsessed with holding onto their low interest rate, a borrower with a fixed-rate loan may avoid refinancing the mortgage in fear of losing their rate.

Meanwhile, a borrower with an ARM will always be keen to shop around in order to save money.

A homeowner can also lose the advantage of a fixed mortgage if they sell or refinance within a few short years.

In that case, they could have just taken out an ARM that was fixed for the first five or seven years and enjoyed a stable interest rate at a lower price.

Finally, a 30-year mortgage lasts for, you guessed it, 30 years. Many people don’t want debt hanging over their head for that long.

So another negative is the time it takes to own that real estate free and clear. That lengthy time span also means a lot of interest is being paid to the bank, as opposed to staying in your bank account.

Of course, you have the option to pay off the mortgage early if you wish.

All in all, fixed mortgages are a good choice for a wide range of borrowers because of the relatively low rate, lack of risk, and absence of surprise.

Read more: 30-year vs. 15-year mortgage

I wanted to fill in the beginning loan, and fixed interest into a chart. I wanted that chart to show the change in amount paid to principle compared to interest for the first few months or for the full 30 years by month. In this way I could tell whether refinancing costs of $5000 were worth the lower interest for the first 10 years. Given $420,000 loan, would I recoup (within 10 years) the $5,000 closing cost — by switching from 3.00% to 2.75% interest?

RJ,

It sounds like you’re looking for a break-even calculator to determine if refinancing can save you money. A .25% is a pretty marginal improvement, especially if costs a lot upfront, but a calculator will show you the cost/benefit over time. Alternatively, you could pay extra each month on the existing loan and potentially achieve similar savings.